Image

May 12, 2025 meeting

This past meeting about the budget, was full of emotion. There were pleas to reduce the mill rate, complaints the mill rate cost was 49 percent higher last year than the previous year, and recommendations.

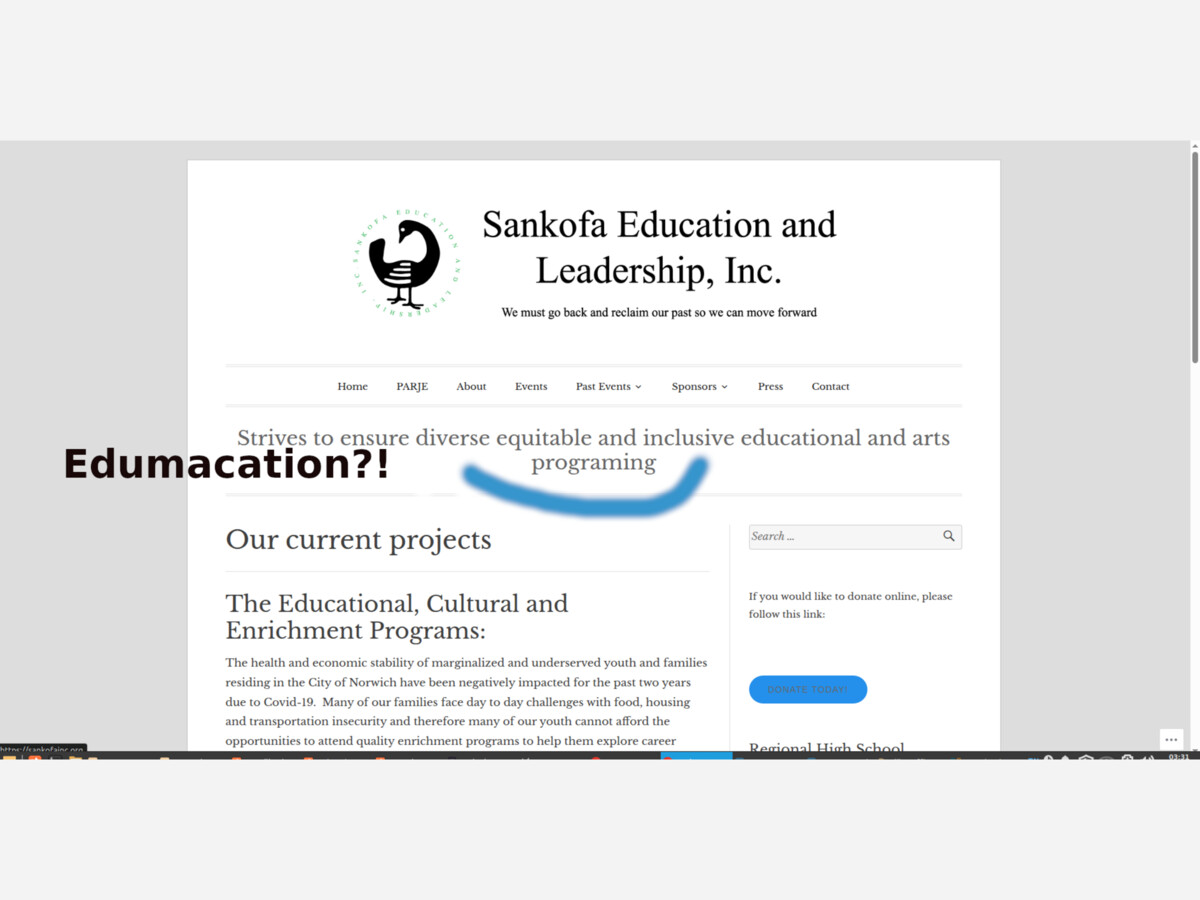

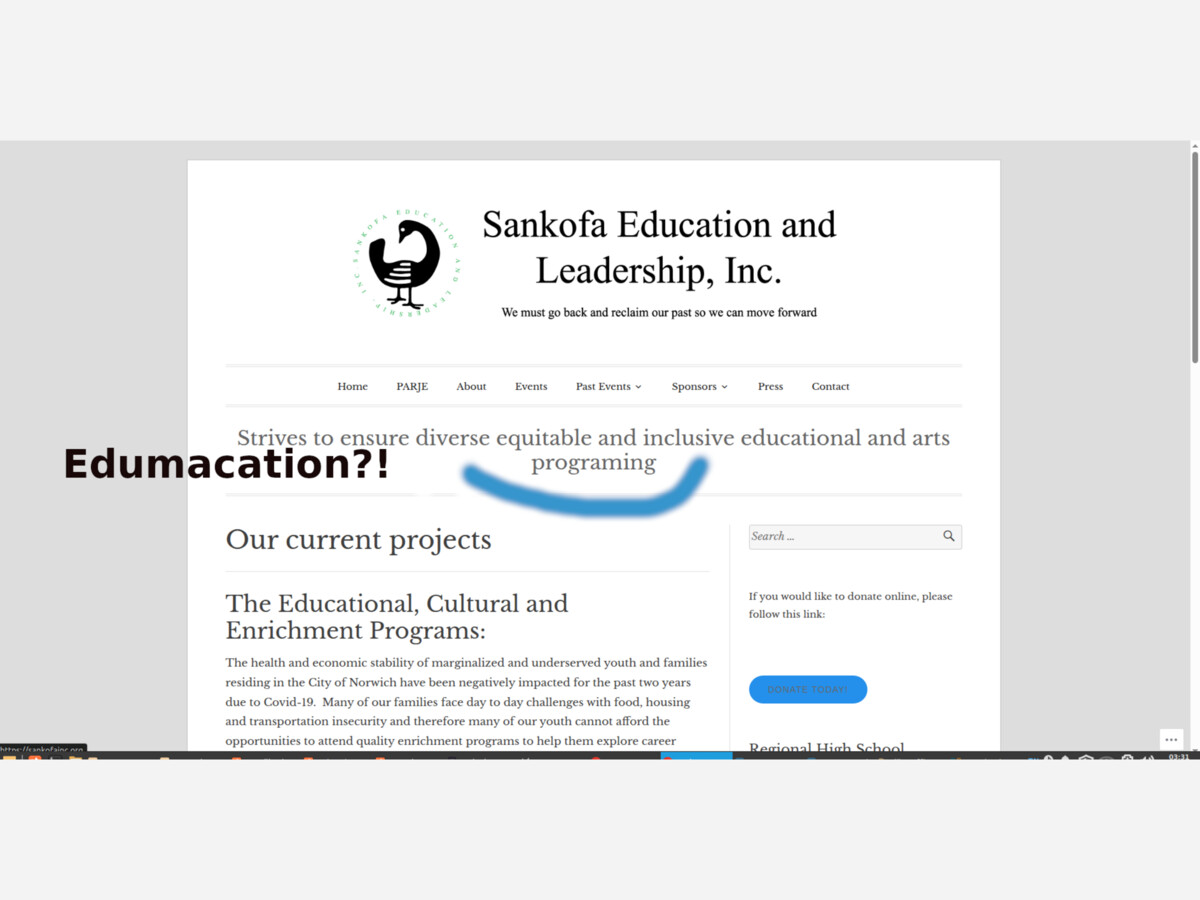

Why Too Many Nonprofits Are Driving Up Property Taxes in Norwich

In cities like Norwich, Connecticut, a troubling trend is quietly squeezing taxpayers: the proliferation of nonprofit organizations. While nonprofits can play valuable roles in a community, the sheer number operating tax-free is contributing to an unsustainable burden on local residents and small businesses.

Nonprofits, by law, are exempt from paying property taxes. In Norwich, these tax-exempt organizations occupy a significant portion of real estate that would otherwise generate much-needed revenue for city services such as schools, infrastructure, and emergency services. As a result, the cost of maintaining those services is shifted onto the shoulders of fewer taxable properties—mostly homes and private businesses.

Take, for example, a controversial decision where residents reportedly opposed the development of a Home Depot—a business that would have generated both property tax revenue and sales tax benefits for the city. Instead, a nonprofit Goodwill store was approved for the same location. Goodwill, as a nonprofit, does not pay property taxes, which means a prime commercial site is no longer contributing to the tax base.

And that’s not an isolated case. Downtown Norwich is home to several other nonprofit entities, such as the SCADD sober house and even the Chamber of Commerce, that do not contribute to the tax rolls. While these organizations may offer social and economic services, their tax-exempt status leaves fewer entities footing the bill.

To make matters worse, many of these nonprofits routinely receive funding from city and state bonds—essentially more money from taxpayers. There are thousands of nonprofit organizations throughout the region, many of which have become adept at tapping into public funding streams while giving little or nothing back in the form of local tax revenue.

This dynamic has led Norwich to adopt one of the highest mill rates in Connecticut. Residents are effectively subsidizing a growing network of tax-exempt entities, often without seeing proportional benefit. Homeowners and small business owners are left to wonder why their property taxes keep rising while large parcels of land remain untaxed.

A balanced approach is overdue. Municipal leaders need to reconsider how many nonprofits the city can realistically support, and perhaps explore alternatives like Payment in Lieu of Taxes (PILOT) programs. Without change, taxpayers will continue to pay more for less, while nonprofits expand their footprint without sharing in the community’s financial responsibilities.

Great information, thanks for sharing. Got me to do a little research. Not a ton of info found so far, but did find this from 2018:

"there was a furor in Norwich when the city’s assessor denied 36 nonprofit tax exemptions this spring. After public outcry from nonprofits, tax assessor Donna Ralston has agreed to review some of the rulings."